Your Insurance Journey

Starts Now

We Insure Everything is here to guide you

every step of the way.

Personal Lines

Personal Insurance

Click to Expand

Home

Do you have the right home insurance?

Does your current home insurance cover all your needs? Chances are, it doesn’t.

As your insurance advisor, we’ll work with you to determine the risks your home faces and customize your coverage to fit your specific needs. Because whether you live in a one-story house or a mansion, it’s the place you call home. And your home deserves to be covered with insurance that’s more than the bare minimum.

Get the insurance your home needs.

Your home is the center of your life. It’s also your biggest investment. So make sure you cover the unique risks you face with home insurance. Get the right policy that will take care of both small and large risks related to owning a home.

What are the risks your home faces?

Imagine if your house caught on fire. Not only would you lose your home, but you’d also be burdened financially and emotionally. Without adequate home insurance, you would be left with no way of raising the funds to pay off the balance of the mortgage. Of course, home insurance may also protect you from more common things like pipe leaks and property damage. Because even small issues can add up, and having comprehensive coverage helps you protect your biggest investment.

Auto, Motorcycle, RV

What is the minimum required coverage?

Remember, not all car insurance is created equal. Some auto insurance policies simply meet legal requirements. In most states, this means your auto insurance will only cover the damage you cause to other cars in collisions. However, auto insurance in some no-fault states will also cover your own car or truck. Additionally, the law usually states that auto insurance policies must cover some medical bills that result from a car crash.

Take your auto policy further with beneficial add-ons.

Other auto insurance policies go further and protect your car or truck if it is stolen, damaged or destroyed by fire, or damaged in a car accident that doesn’t involve any other vehicles. You can also get policies that protect your car if it is damaged by an uninsured driver.

Talk with us and ensure you have the proper car insurance coverage in place with the right insurance company. Otherwise, you’re putting yourself, your family, and others at risk.

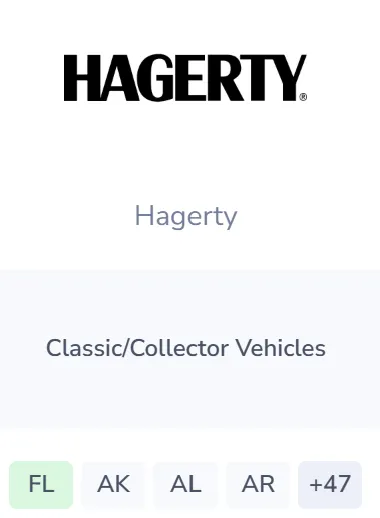

Classic Car, Racing, Specialty

Preserving your cherished collector car demands a specialized approach to insurance, tailored to meet the unique needs of classic car enthusiasts like yourself.

Elevated coverage beyond standard auto insurance. Your classic car holds significant sentimental and financial value, warranting insurance coverage that goes beyond the ordinary. Classic car insurance stands as a distinct category, offering notable deviations from conventional auto policies.

Diverse protections for collector, antique, and classic automobiles. Let's begin with terminology. Policies may vary in name, labeled as classic, collector, or antique car insurance. Generally, these policies extend coverage to vehicles meeting specific age criteria and possessing distinctive features, such as rarity.

Agreed-upon value for peace of mind. The primary disparity between classic car coverage and traditional auto insurance lies in valuation. Unlike standard policies that assess market cash value at the time of a claim, classic car insurance typically involves the insurer agreeing upon a predetermined value for the vehicle. In the event of damage or total loss, your payout aligns with this prearranged value, ensuring clarity and certainty.

Guaranteed coverage for authentic parts. In the aftermath of a collision, classic car policies often guarantee coverage for authentic parts essential for repairs. This assurance extends beyond the limitations or exclusions encountered in typical auto insurance policies.

Restricted usage for special vehicles. It's essential to note that many classic car policies are tailored for limited use, whether restricting annual mileage or confining coverage to specific activities like exhibitions and parades, excluding everyday driving scenarios.

Connect with us to explore tailored insurance solutions for your classic, collector, or antique car. We're here to assist you in securing the ideal policy for your unique needs!

Condo

What is covered by condo insurance?

Your condo association’s insurance typically extends to shared areas, but not your specific unit's improvements or your personal possessions. Condo insurance fills these gaps, blending elements of landlord and renters' insurance tailored to your condo.

Safeguarding your belongings.

Condo insurance shields your personal items within your unit, from appliances to attire, against loss or damage. Without it, replacing your possessions would come directly out of your pocket. This coverage also encompasses theft, fire, windstorms, lightning, and burst pipes. Yet, it's essential to understand that condo insurance generally excludes coverage for flooding.

Options for liability coverage.

Beyond property protection, condo policies often encompass liability coverage. For instance, if a visitor sustains an injury in your condo, this coverage can handle their medical bills. It also extends to instances where you're held responsible for damaging another condo property, offering protection against potential lawsuits. Additionally, if your unit becomes uninhabitable due to damage, living expenses may be covered. Tailored coverage for your condo. Determining the precise coverage needed for your condo unit can be complex, but we're here to simplify the process. We'll collaborate with you to identify the condo insurance policy that aligns with your requirements. Moreover, we'll illustrate the affordability of condo insurance compared to the potential expenses of replacing your belongings independently. Streamlined guidance.

We make navigating condo insurance straightforward by clarifying what your condo association's policy lacks and how your insurance can bridge the gaps. Reach out to us today to explore your condo insurance options.

Watercraft, Boats, Yachts

Understanding the Financial Risks of Boat Ownership.

While the allure of being out on the water is undeniable, the financial responsibilities that come with owning a boat cannot be overlooked. Fortunately, watercraft insurance exists to alleviate these concerns, allowing you to fully embrace your time on the water with peace of mind.

Coverage for Damage and Liability Boat insurance, also known as watercraft insurance, typically comprises two primary components along with two optional add-ons worth considering. Firstly, standard coverage includes protection against physical damage to your vessel resulting from various perils such as collisions, fires, adverse weather conditions, theft, or vandalism. Secondly, liability coverage ensures that you're financially safeguarded in the event of damage caused to other boats or individuals, including associated legal expenses. Additionally, it's advisable to seek insurance policies that extend coverage to the cleanup costs of any oil spillages resulting from severe damage to your boat.

Enhancing Your Boat Policy with Optional Add-Ons

In addition to standard coverage, watercraft insurance offers optional add-ons to further tailor your policy to your specific needs.

Protection for Personal Possessions One valuable optional element is coverage for theft or damage to personal belongings kept or utilized on your boat. Considering the expenses associated with sports or fishing equipment and high-end gadgets, this coverage proves invaluable in safeguarding your investments.

Boat Towing and Assistance Another optional feature is boat towing and assistance coverage, providing protection against the unexpected costs that may arise if your boat experiences a breakdown while on the water. This coverage ensures prompt assistance and towing services, mitigating potential financial burdens during such incidents.

Make the Most of Your Time on the Water Spending time on the water should be enjoyable and worry-free. Connect with us today to explore the various options available for enhancing your boat insurance coverage and ensure that you're adequately protected for all your aquatic adventures.

Umbrella

Safeguarding Your Financial Future with Umbrella Insurance

Facing significant insurance claims or lawsuits can pose a threat to your financial stability, especially if the costs surpass the coverage provided by your standard homeowners and auto policies. We're here to offer additional protection to mitigate such risks.

An Extra Layer of Protection Umbrella insurance, despite its peculiar name, offers a straightforward solution – it's an additional liability policy designed to provide enhanced peace of mind. Typically obtained alongside your existing car insurance or homeowners insurance policy, it serves as a supplemental layer of coverage.

Focused on Liability Protection Umbrella insurance is primarily concerned with liability claims, which entail the potential costs you might be obligated to pay to another party in the event of an unforeseen incident for which you are held accountable. Unlike standard policies, it typically excludes coverage for personal losses such as property damage or theft of possessions.

Renters

Exploring Liability Coverage in Renters Insurance

In addition to property coverage, renters insurance often includes liability coverage, offering you further protection in various scenarios. Let's delve into some key aspects:

Protection Against Liability Liability coverage in renters insurance safeguards you in situations where you inadvertently damage the rental property or if a visitor sustains an injury while at your apartment. Your insurance policy would cover the associated expenses in such instances, providing you with financial security and peace of mind.

Coverage for Loss of Use Renters insurance may also provide compensation for living expenses if the rental property becomes uninhabitable due to events covered by the policy. This coverage acts as a safety net, helping you manage expenses incurred from such unforeseen circumstances that would otherwise burden you financially.

Exclusions to Note While renters insurance offers comprehensive coverage, certain exceptions exist. For instance, if you park your vehicle on the rental property, your car typically won't be covered by renters insurance. It's important to be aware of such limitations and seek additional coverage if needed.

Affordable Protection for Renters Renters insurance offers a cost-effective way to protect yourself and your belongings. Whether you rent a home or a studio apartment, having renters insurance ensures that you're adequately covered against potential risks.

Let Us Guide You Navigating the realm of insurance options can be overwhelming, but we're here to help you understand the available choices and select the right coverage for your needs. Reach out to us today, and we'll walk you through the options to ensure you have the insurance coverage and protection necessary for your peace of mind.

Pet

Securing Comprehensive Coverage for Your Furry Friends

Your pets are cherished members of your family, deserving of the best care possible. With specialized pet insurance, you can provide them with the coverage they need to address accidents, illnesses, and other medical needs without facing exorbitant veterinary bills.

Tailored Coverage for Your Pets

Pet insurance, while akin to healthcare coverage, is typically simpler than human medical insurance. When selecting a policy, you'll generally encounter three primary types of coverage options: accidents only; accidents and illnesses; or comprehensive coverage encompassing accidents, illnesses, and other medical costs. Each option comes with its own deductible and co-payment requirements.

Understanding Policy Options

Nearly every pet insurance policy features some form of payout limit, which may apply to a single treatment, all treatments for a specific condition, or the total amount payable within a year. The premium costs will vary based on the type and amount of the payout limit, necessitating careful consideration when choosing a policy.

Key Factors to Consider

When exploring coverage options for your pets, it's essential to be mindful of several factors. For instance, many policies include a waiting period of approximately two weeks after issuance, during which claims for illnesses or accidents cannot be made. Additionally, unlike human medical policies, pet insurance often requires you to pay veterinary bills upfront and subsequently file a claim for reimbursement from the insurer.

Get Peace of Mind for Your Pet's Health

Navigating the intricacies of pet insurance can be overwhelming, but we're here to help you understand the available options and select the most suitable coverage for your furry companions. Contact us today to learn more about insuring your pets and ensure they receive the care they deserve.

Special Event

Understanding Event Insurance: Protecting Your Celebrations

Hosting an event, whether at a venue or your home, involves meticulous planning and preparation. Amidst the excitement, it's essential to prioritize protecting your festivities with special event insurance, which safeguards against potential risks and unexpected challenges.

Event Liability Coverage: A Necessity

Event liability insurance is a crucial component of your coverage, often mandated by venues. It provides protection for liability issues such as property damage or personal injury caused by you or your guests during the event. For instance, if a guest damages property or sustains an injury, this coverage may help cover medical bills and replacement costs. However, it typically excludes third-party equipment rentals.

Coverage for Event Cancellation

Event cancellation insurance offers reimbursement for lost deposits and fees if you need to cancel or postpone your event due to unforeseen circumstances. This coverage protects against scenarios like vendor bankruptcy, extreme weather, or sudden illness affecting you or a family member, including communicable diseases like COVID-19.

Host Liquor Liability Insurance: Mitigating Alcohol-Related Risks

When alcohol is served at your event, host liquor liability insurance becomes essential. It provides protection in the event of alcohol-related accidents resulting in property damage or injury. This coverage safeguards against potential lawsuits, medical bills, and property damage arising from alcohol consumption at your event.

Coverage for Various Events

Special event insurance can cover a wide range of occasions, including weddings, anniversaries, birthdays, retirements, graduations, family reunions, and baby showers. However, exclusions may apply to specific events like bachelorette and bachelor parties.

Timing of Coverage

It's advisable to obtain special event insurance once you begin making deposits and payments for vendors and services. The duration of your event and its complexity may impact your coverage needs, so it's essential to plan accordingly.

Plan Your Event with Confidence

Don't let unforeseen events derail your celebrations. Prioritize securing special event insurance to ensure peace of mind and protection for your cherished gatherings. Contact us today to discuss your event and explore available coverage options tailored to your needs.

Wedding

Securing Your Special Day with Wedding Insurance

Your wedding day should be filled with joy and excitement, not stress and worry. Wedding insurance offers peace of mind by protecting against potential risks and unforeseen circumstances. Here's what you need to know about this specialized type of event insurance:

Tailored Coverage for Your Unique Day

Just as every wedding is unique, wedding insurance policies are customized to fit the specific needs of each couple. These policies typically cover three main risks:

Postponement: If your wedding needs to be postponed due to specific reasons such as illness or military deployment.

Accidental Damage: Protection against accidental damage to important materials such as food, wedding attire, or rings.

Service Supplier Issues: Coverage for situations where service suppliers such as DJs or florists fail to fulfill their obligations, such as bankruptcy or non-appearance.

Understanding Coverage Exceptions

It's important to note that while wedding insurance provides comprehensive coverage, there may be exceptions to the conditions of coverage. For instance, most policies only cover extreme weather events like hurricanes rather than minor weather disruptions such as rain. Additionally, coverage for situations like a bride or groom getting cold feet is rarely included.

Finding the Right Coverage for You

Determining if wedding insurance is the right choice for your special day is crucial. By contacting us, you can explore your options and ensure that you have the appropriate coverage in place to protect your wedding day from unexpected setbacks.

Celebrate with Confidence

Don't let worries overshadow your wedding day. With wedding insurance, you can celebrate with confidence, knowing that you're protected against unforeseen circumstances. Contact us today to learn more about wedding insurance and find the coverage that fits your needs.

Flood

Dispelling Flood Insurance Myths: Protecting Your Home from Rising Waters

Flood insurance is a critical component of safeguarding your home, yet several misconceptions persist regarding its necessity and coverage. Let's debunk three common myths surrounding flood insurance:

Myth 1: Flood Risk is Limited to Designated Flood Zones

Contrary to popular belief, flooding poses a risk regardless of your location. Devastating flood damage can occur anywhere, making flood insurance essential for all homeowners, not just those in designated flood zones.

Myth 2: Homeowners Insurance Includes Flood Coverage

Many homeowners assume that their standard homeowners insurance policy automatically covers flood damage. However, this is rarely the case. It's crucial to understand that flood coverage is typically not included in homeowners insurance policies unless explicitly stated otherwise.

Myth 3: Government Programs Provide Adequate Coverage

While there is a National Flood Insurance Program aimed at guaranteeing insurance availability in certain areas, it covers only a small percentage of American homes. Relying solely on government programs for flood insurance may leave you underinsured and vulnerable in the event of a flood.

The Importance of Flood Insurance

For most homeowners, floods represent a low probability but high-cost risk. Without flood insurance, you could face significant financial losses, including damage to personal possessions, extensive reconstruction expenses, and even displacement from your home for an extended period. In such cases, not having flood coverage is a risk that homeowners cannot afford to take.

Secure Your Home with Flood Insurance

Protecting your home from the devastating effects of flooding requires proactive measures, including obtaining a separate flood insurance policy. By contacting us, we can guide you through the benefits of securing flood insurance and ensure that your home is adequately protected against rising waters. Don't wait until it's too late—reach out to us today to learn more about flood insurance options tailored to your needs.

Valuable Possesions

Protecting Your Precious Belongings: Valuable Possessions Insurance

Your most cherished possessions deserve the utmost protection, especially in the event of loss or damage. While standard homeowners or renters insurance policies provide coverage, they may have limitations that leave your valuable items underinsured. Valuable possessions insurance offers specialized coverage to ensure your most prized belongings are adequately protected.

Addressing Coverage Gaps

Most homeowners or renters insurance policies impose limits on the amount they will pay for individual items, which may not fully cover expensive possessions like jewelry or artwork. Valuable possessions insurance fills this gap by providing coverage tailored to the actual replacement value of each item, ensuring you receive adequate compensation in the event of loss or damage.

Benefits of Valuable Possessions Insurance

In addition to ensuring you receive the actual value for your covered items, valuable possessions insurance offers other key benefits:

1. Accidental Damage Coverage: Many policies include coverage for accidental damage to expensive items, such as jewelry or artwork, which may not be covered by standard homeowners insurance.

2. Coverage Beyond the Home: Unlike homeowners insurance, which typically restricts coverage to items kept within the home, valuable possessions insurance often extends coverage to items you wear or carry outside the home, such as jewelry worn on special occasions or everyday accessories.

Making Informed Decisions

Determining if valuable possessions insurance is right for you depends on various factors, including the value and significance of your belongings. Our team can help you assess your needs and decide if this specialized coverage is a good fit for protecting your most treasured possessions.

Protect Your Prized Possessions

Don't leave your most valuable items vulnerable to loss or damage. Contact us today to learn more about valuable possessions insurance and ensure your cherished belongings are properly protected against theft, accidents, and natural disasters. We're here to help you make informed decisions and provide the peace of mind you deserve.

Excess Liability

Enhance Your Protection with Excess Liability Insurance

When it comes to securing your financial well-being, excess liability insurance offers an additional layer of protection beyond your standard insurance policy. Here's why it's essential for taking your coverage to the next level:

Comprehensive Coverage for Peace of Mind

Excess liability insurance complements your primary insurance policy, typically covering costs associated with third-party claims rather than your own expenses. This additional coverage provides peace of mind, knowing that you're safeguarded against unforeseen liabilities that may exceed your original policy's coverage limits.

Understanding Excess Liability Coverage

An excess liability policy comes into play only after your primary policy has paid out in full and reached its coverage limit. At this point, the excess policy kicks in to cover any remaining costs, ensuring that you're not left exposed to financial liabilities beyond your coverage limits. Because excess liability insurance is less likely to pay out than a standard policy, premiums are often more affordable.

Differentiating Between Excess Liability and Umbrella Insurance

While the terms "excess liability" and "umbrella insurance" are sometimes used interchangeably, there are nuanced differences between the two. Some insurers may distinguish umbrella insurance as providing coverage for risks and situations not covered by the standard policy, whereas excess liability simply extends the payout limit. However, terminology can vary between insurers, so it's essential to review your policies carefully to understand the specifics of your coverage.

Get Extra Reassurance with Excess Liability Insurance

For added reassurance and comprehensive protection, consider adding excess liability insurance to your coverage portfolio. Contact us today to learn more about how excess liability insurance can enhance your financial security and provide you with the peace of mind you deserve. We're here to help you navigate your insurance options and find the right coverage for your needs.

Secondary Home

Insuring Your Vacation Property: Key Considerations

Owning a vacation property offers a refreshing escape from the daily routine, but it also presents unique risks that require specialized insurance coverage. Here are some factors to consider when insuring your secondary home:

Understanding Secondary and Seasonal Homes

The distinction between secondary and seasonal homes can vary among insurers. Generally, a secondary home is one that is occupied for short periods, while a seasonal home is used for longer stays but only at certain times of the year. Clarifying the classification with your insurer ensures you obtain the appropriate coverage.

Unique Risks and Coverage Needs

Vacation home insurance shares similarities with homeowners insurance but also addresses unique risks. Since vacation properties are often left unattended for extended periods, they are more susceptible to burglary, fire, and flooding. Tailored insurance policies for vacation homes account for these risks and provide comprehensive coverage.

Lower Coverage Limits

Coverage limits for vacation homes may be lower compared to primary residences due to the assumption of fewer and less valuable possessions being kept at the property. It's essential to ensure that your insurance policy offers adequate coverage for both the property and its contents, considering the unique circumstances of a vacation home.

Finding the Right Coverage

Given the specific risks associated with vacation properties, it's crucial to select an insurance policy that meets your needs without overpaying. Our team is here to assist you in navigating the insurance options available for your vacation home, ensuring you obtain the appropriate coverage at a fair price.

Protect Your Vacation Retreat

Don't leave your vacation property vulnerable to unforeseen risks. Contact us today to discuss your insurance options and secure the right coverage for your secondary or seasonal home. With our guidance, you can enjoy peace of mind knowing that your getaway is adequately protected against potential threats.

Mortgage Protection, Final Expense

Planning for end-of-life expenses is a vital part of financial preparation, and final expense insurance offers a solution to ease the burden on loved ones during a challenging time. Here's why final expense insurance is worth considering:

Medicare Coverage Limitations

It's important to note that Medicare does not cover funeral costs or other end-of-life expenses. Final expense insurance steps in to fill this gap, providing a reliable source of funds to cover funeral expenses, outstanding debts, probate fees, and related costs.

Comprehensive Coverage for Funeral Costs

Funerals can be costly, with expenses ranging from embalming and cremation to caskets and minister fees. Final expense insurance offers coverage specifically designed to handle these expenses, ensuring that your loved ones are not burdened with financial strain during their time of grief.

Simplified Enrollment Process

Final expense insurance typically does not require a medical exam and offers fixed premiums for the duration of the policy. This simplified enrollment process makes it easy to obtain coverage, regardless of your health status.

Flexibility in Usage

While the beneficiary ultimately decides how to use the funds, final expense insurance policies are intended to cover funeral and related costs. This clear intention ensures that your wishes are honored and provides peace of mind that your loved ones will be taken care of.

Complementing Existing Life Insurance

While permanent and term life insurance may serve different financial needs, final expense insurance provides dedicated coverage for end-of-life expenses. As individuals age and their financial priorities shift, final expense insurance offers a cost-effective solution to ensure that funeral costs are covered without the need for extensive medical evaluations.

Securing Your Financial Future

Preparing for end-of-life expenses is a responsible financial decision, and final expense insurance offers a practical solution to address this need. If you're considering final expense insurance and want to explore your options, contact us today. We're here to help you find the right coverage to protect your loved ones and provide peace of mind for the future.

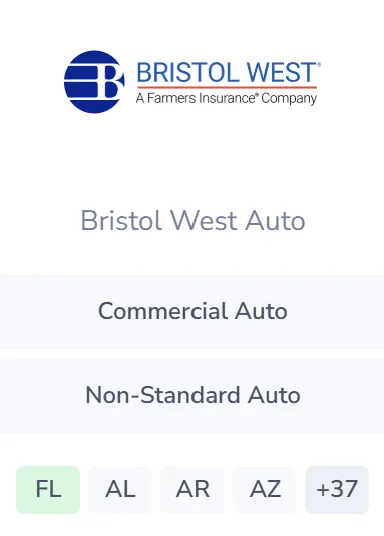

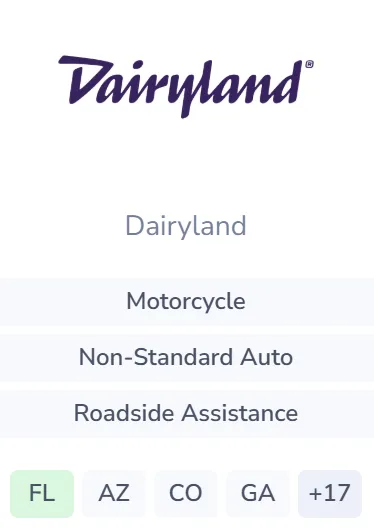

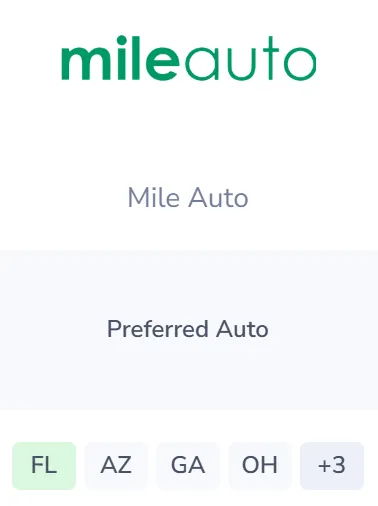

Our Preferred Carriers

Coastal and high-risk homeowners deserve choice, service, and certainty. Annex Risk partners with A.M. Best "A" rated insurance carriers to offer an HO-3 product for high-risk homes along the Gulf Coast and Eastern Seaboard. They work in some of the most natural catastrophe exposed regions to provide peace of mind to homeowners.

Coastal and high-risk homeowners deserve choice, service, and certainty. Annex Risk partners with A.M. Best "A" rated insurance carriers to offer an HO-3 product for high-risk homes along the Gulf Coast and Eastern Seaboard. They work in some of the most natural catastrophe exposed regions to provide peace of mind to homeowners.

Get Covered offers you and your customers the ability to quote and bind renters insurance in less than 1 minute, for as low as 50 cents per day!

National General, an Allstate company, has a dedicated agency processing system, enabling you to be nimble, with your needs in mind.Including Motorcycle, NFIP, Non-Standard Auto, Recreational Vehicles, Standard Auto & Renters

SES Risk Solutions is a leading, tech-enabled insurance provider for residential investment properties. Program Appetite: Residential long term rental properties only. Including SFR 1-4 single location and portfolio, MFR 5+ unit and Property Manager portfolios.

AssuranceAmerica is proud to offer great rates at an affordable price. We are a State Minimum Limits Nonstandard Auto Insurance Company in business since 1998 offering competitive rates to high-risk drivers. We also accept the most forms of identification, such as: Foreign Drivers Licenses, Matriculas, Passports, Etc. However, we do also have very competitive rates for ALL drivers ages 24-65 and for vehicles 3 model years old and older.

Small Call to Action Headline

Elephant prides themselves on being a digital-first, customer-focused auto insurance carrier on a mission to help you grow your business. Elephant also offers up to a 10% bundling discount with any in-agency homeowners or renters policy.

Small Call to Action Headline

Small Call to Action Headline

Small Call to Action Headline

Small Call to Action Headline

Small Call to Action Headline

Small Call to Action Headline

Small Call to Action Headline

Our Services

What Makes Our Independent Agency Different?

We represent multiple insurance companies.

We are by your side every step of the way.

We are licensed insurance advisors.

We offer a variety of insurance solutions.

We are there for you in your time of need.

Who we are:

Over 20 years of Insuring the Brickell area of Miami, FL

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

"We believe in being a trusted source for each of your insurance needs, dedicated to bringing you advice and options to help you make an informed decision."

- Mikell Simmons, Founder

It is a long established fact that a reader will be distracted by the readable content of

a page Lorem ipsum dolor sit amet consectetur.

Client's Say

Our Mission Statement

At We Insure Everything, our mission is to uphold our founding principles of bringing our clients the highest quality services and solutions to match up with the unique needs of today’s world.

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

Ines - HR 29 September

“Mickell is a very dedicated person, he took the time to look for the best options that would suit my needs and my budget and went through the details and the language of the policy to make it easier for me to understand.”

Santiago - Mgr Dir 14 September

"Mikell thank you for the great work, your sincere approach is really appreciated. You tell me you don't know the details sometimes of something but always seem to find the answer; I like how I can trust you."