Your Insurance Journey

Starts Now

We Insure Everything is here to guide you

every step of the way.

Quick & Easy, Self-Quoting Tools:

Health, Life & Disability

Life, Disability, LTC & Annuities

United Health Insurance

Aetna Health Insurance

ACA Health Insurance

Commercial,

Gen Liability

How can we help you?

Health, Life, Disability

Click to Expand

Health

Navigating the world of individual health insurance can be overwhelming, but it's a critical step for those without employer-sponsored plans or who are self-employed. Here's how we can help you find the right coverage for your needs:

Affordable Options Tailored to You Year-Round

Individual health insurance plans can be more affordable than you might think, especially when you explore different options and balance premium costs with coverage. We'll work with you to find a plan that fits your budget and provides the coverage you need.

Key Considerations for Choosing a Policy

When selecting a health insurance policy, several factors come into play. We'll help you understand and navigate these variables, including the deductible, co-payments, annual limits, and covered services. By considering your health status and risk tolerance, we can tailor a plan that meets your specific needs.

Comprehensive Coverage for Preventative Care

Preventative care is a cornerstone of individual health insurance plans. Most insurers cover preventative services, such as checkups, screenings, and vaccines, at little to no cost to you. We'll ensure that your policy includes robust coverage for preventative care to help you maintain optimal health.

Expert Guidance Every Step of the Way

Health insurance can be complex, but you don't have to navigate it alone. Our team is here to provide expert guidance and support throughout the process. Whether you have questions about coverage options, want to understand your policy in detail, or need assistance with claims, we're here to help. Don't let the complexities of health insurance deter you from securing the coverage you need. Contact us today to learn more about individual health insurance options and find the ideal plan for your circumstances.

Life

Protecting your family's future is a top priority, and individual life insurance is a crucial investment in their security. While navigating the complexities of life insurance may seem daunting, our team is here to guide you every step of the way. Here's what you need to know:

Understanding Your Options: Term, Whole, and Universal Life Insurance

When choosing a life insurance policy, you'll encounter three main types: term life insurance, whole life insurance, and universal life insurance. Each type has its own features and benefits, so it's essential to understand how they work and which option aligns best with your needs.

Term Life Insurance: Provides coverage for a specified period, with the policy paying out a death benefit if you pass away during that time frame. This option is often more affordable and straightforward, making it an attractive choice for many individuals.

Whole Life Insurance: Offers coverage for your entire life, with premiums typically remaining consistent throughout the policy's duration. Whole life policies also accumulate cash value over time, which can be accessed or borrowed against if needed.

Universal Life Insurance: Combines the flexibility of whole life insurance with additional features, such as adjustable premiums and death benefits. With universal life insurance, you have the ability to customize your policy to fit your changing needs and financial goals.

Factors to Consider Before Purchasing Life Insurance

Before committing to a life insurance policy, several factors should be taken into account. These include your age, health status, desired coverage amount, and financial objectives. By evaluating these factors, you can make an informed decision about the type and amount of coverage that's right for you and your family.

Expert Guidance Every Step of the Way

Choosing the right life insurance policy requires careful consideration and expert guidance. Our team is here to provide the support and assistance you need to navigate the process with confidence. Whether you're exploring your options or ready to purchase a policy, we'll work with you to find the solution that offers peace of mind and protection for your loved ones.

Don't delay in securing your family's future. Contact us today to learn more about your life insurance options and take the first step toward ensuring their financial security.

Considering child life insurance is a sensitive topic, but understanding its potential benefits can help you make an informed decision for your family's future. Here's what you need to know:

Exploring the Advantages of Child Life Insurance

While life insurance for children may not be a common consideration, it offers several advantages that can provide valuable protection and financial security for your family:

1. Coverage for Unexpected Expenses: Child life insurance can help cover funeral costs, counseling services, and time off from work in the event of a child's untimely passing. Having this coverage can alleviate the financial burden during an emotionally challenging time.

2. Savings and Investment Opportunity: Child life insurance policies, typically whole life policies, accumulate cash value over time. This cash reserve can serve as a form of savings, helping to fund future expenses such as college tuition or a down payment on a home. Additionally, the cash value can be accessed through withdrawals or used as collateral for loans, providing financial flexibility.

3. Securing Future Insurability: Starting a life insurance policy for a child at a young age can lock in their insurability for the future. This is particularly beneficial if the child develops a medical condition later in life that could make it challenging to obtain life insurance coverage. By initiating a policy early, you ensure that your child has access to coverage as an adult, regardless of their health status.

Determining If Child Life Insurance Is Right for Your Family

The decision to purchase child life insurance depends on various factors, including your financial situation, long-term goals, and risk tolerance. It's essential to assess whether the benefits of child life insurance align with your family's needs and priorities.

Seeking Expert Guidance

Given the complexity of life insurance and the sensitive nature of insuring children, it's advisable to seek expert guidance when considering child life insurance. Our team can provide personalized advice and assistance, helping you evaluate your options and make an informed decision. Contact Us Today If you're unsure whether child life insurance is the right choice for your family, we're here to help. Contact us today to discuss your concerns, explore your options, and determine the best course of action to protect your family's financial future.

Disability

Long-term disability insurance can provide crucial financial support if you're unable to work due to a serious illness or injury. Here's what you need to know about this type of coverage:

Understanding Long-Term Disability Insurance

Long-term disability insurance is designed to replace a portion of your income if you become disabled and are unable to work for an extended period. It offers financial protection by providing regular payments to help cover living expenses and maintain your standard of living during your disability.

Key Features and Options

When considering long-term disability insurance, it's essential to understand the following features and options:

1. Waiting Period: This is the period of time between when you become disabled and when your benefits begin. Policies typically have a waiting period ranging from 30 to 90 days, during which you must be disabled before benefits are payable.

2. Benefit Period: The benefit period determines how long you'll receive disability payments. Some policies offer benefits until you reach retirement age, while others provide benefits for a fixed period, such as two, five, or ten years.

3. Benefit Amount: Long-term disability insurance typically replaces a percentage of your pre-disability income, usually ranging from 50% to 70%. You can choose a payout level that aligns with your financial needs and budget.

4. Employer Coverage vs. Individual Policy: Many employers offer long-term disability insurance as part of their benefits package. While employer-provided coverage can be convenient, it's essential to review the policy's terms and ensure it meets your needs. Consider supplementing employer coverage with an individual policy to customize your protection.

Benefits of Long-Term Disability Insurance

Having long-term disability insurance offers several benefits, including:

- Financial Security: Disability insurance provides a financial safety net, ensuring you have income to cover essential expenses and maintain your quality of life if you're unable to work.

- Peace of Mind: Knowing that you have disability insurance in place can offer peace of mind, allowing you to focus on recovery without worrying about financial strain.

- Customizable Coverage: Long-term disability policies can be tailored to your specific needs and preferences, allowing you to choose waiting periods, benefit periods, and benefit amounts that suit your situation.

Expert Guidance

Navigating the details of long-term disability insurance can be complex, so it's essential to work with an experienced insurance professional. Our team can help you understand your options, compare policies, and choose the coverage that provides the best protection for you and your family.

Contact Us Today

If you're considering long-term disability insurance or have questions about your coverage options, we're here to help. Contact us today to discuss your needs and find the right insurance solution for your circumstances.

Dental / Vision

It's important to prioritize dental care as part of your overall health routine. Dental insurance can help you manage the costs of routine check-ups, cleanings, and other necessary treatments. Here's what you need to know about dental insurance:

Understanding Dental Insurance

Dental insurance provides coverage for a range of dental services, including preventive care, diagnostic services, and treatments such as fillings, root canals, and orthodontic care. By having dental insurance, you can access these services at a reduced cost, helping you maintain good oral health and prevent more significant dental issues in the future.

Key Features of Dental Insurance

When considering dental insurance, here are some key features to keep in mind:

1. Covered Services: Dental insurance typically covers services such as routine exams, cleanings, X-rays, fillings, and extractions. Some plans may also cover more extensive treatments like crowns, bridges, and dental implants.

2. Waiting Periods: Some dental insurance plans may have waiting periods before certain services are covered. Be sure to review the policy terms to understand any waiting periods that may apply.

3. Deductibles and Copayments: Like other types of insurance, dental plans may have deductibles and copayments that you are responsible for paying. These costs can vary depending on the specific plan you choose.

4. Network Providers: Many dental insurance plans have networks of preferred providers, which can help you save on out-of-pocket costs. Be sure to check if your dentist is in-network to maximize your benefits.

Benefits of Dental Insurance

Having dental insurance offers several benefits, including:

- Cost Savings: Dental insurance helps you save money on routine and unexpected dental expenses by covering a portion of the costs.

- Preventive Care: Regular dental check-ups and cleanings are essential for maintaining oral health. Dental insurance encourages preventive care by covering these services at little to no cost to you.

- Access to Care: With dental insurance, you have access to a network of dentists and specialists who can provide the care you need to keep your smile healthy.

Choosing the Right Plan

When selecting a dental insurance plan, consider factors such as the coverage offered, monthly premiums, deductibles, and copayments. It's essential to choose a plan that meets your needs and fits your budget.

Expert Guidance

Navigating the options for dental insurance can be overwhelming, but we're here to help. Our team can assist you in finding the right dental insurance plan that provides the coverage you need at a reasonable cost.

Contact Us Today

If you're interested in dental insurance or have questions about your coverage options, don't hesitate to reach out. We're committed to helping you prioritize your dental health and achieve a healthy smile for years to come.

Critical Illness

Here's how you can promote critical illness insurance to your employees:

1. Educate Them: Provide information sessions or materials explaining what critical illness insurance is and how it works. Help them understand that it's a supplemental insurance that pays a lump sum benefit if they're diagnosed with a covered critical illness such as cancer, heart attack, or stroke.

2. Highlight Coverage Gaps: Explain to employees that health insurance may not cover all expenses associated with a critical illness. Emphasize potential out-of-pocket costs, including deductibles, copayments, and expenses for out-of-network care. Critical illness insurance can help fill these gaps and provide financial support during a difficult time.

3. Stress Financial Protection: Encourage employees to consider the financial impact of a critical illness on their families. Critical illness insurance can provide a lump sum benefit that can be used to cover medical bills, living expenses, and other financial obligations while they focus on recovery.

4. Offer Choice: Provide employees with options for critical illness insurance coverage. Allow them to choose the level of coverage that best meets their needs and budget. Consider offering voluntary critical illness insurance as part of your employee benefits package.

5. Provide Support: Make sure employees have access to resources and support to help them understand their insurance options. Offer assistance in selecting the right coverage and navigating the claims process if they ever need to file a critical illness insurance claim.

By promoting critical illness insurance to your employees, you can help them protect themselves and their families from the financial burden of a serious illness. It's an important benefit that can provide peace of mind and financial security during challenging times.

Long Term Care

Long-term care insurance can provide valuable coverage if you develop a chronic illness or disability and require extended care services. Here's what you need to know about long-term care insurance:

1. Coverage Gap: Most medical insurance plans do not cover long-term care services, leaving individuals responsible for the substantial costs associated with nursing home care, assisted living facilities, home modification, and other long-term care needs.

2. Wide-Ranging Expenses: Long-term care insurance policies typically cover a variety of services and expenses, including nursing home care, adult day care, in-home care, and assisted living facilities. These policies offer financial protection against the high costs of long-term care, providing peace of mind for policyholders and their families.

3. Payment Limits and Schedules: Long-term care insurance policies may have limits on the duration of coverage or the total amount that can be paid out. Payment schedules vary, with some policies specifying maximum amounts for each type of care and others providing a pooled benefit that can be used flexibly to cover various long-term care needs.

4. Coverage Details: It's essential to review the coverage details of a long-term care insurance policy carefully. Consider factors such as approved care facilities, required medical examinations, and pre-existing condition limitations. Some policies may require a waiting period before coverage begins for certain conditions.

5. Inflation Protection: Long-term care insurance policies may offer options for inflation protection to ensure that coverage keeps pace with rising care costs over time. Considering the potential for long-term care needs and the effects of inflation, selecting a policy with appropriate inflation protection is crucial.

Navigating the complexities of long-term care insurance can be challenging, but our team is here to help. Contact us to explore your options for long-term care insurance coverage and determine if it's the right fit for you and your family's needs. We'll guide you through the process and help you make informed decisions about your long-term care planning.

Medicare

Medicare is a vital government-sponsored health insurance program in the United States, offering coverage to eligible individuals aged 65 and older, as well as certain younger people with disabilities or end-stage renal disease. Let's delve into the details of Medicare and its various components:

1. Original Medicare (Parts A and B):

- Part A: Covers hospital-related expenses such as inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services.

- Part B: Covers medical services and supplies that are not considered hospital-related, including doctor visits, outpatient care, preventive services, and durable medical equipment.

2. Medicare Advantage (Part C):

- Also known as Medicare Part C, these plans are offered by private insurance companies approved by Medicare.

- Medicare Advantage plans provide all the benefits of Parts A and B, and often include additional benefits such as prescription drug coverage, vision, dental, and hearing coverage.

- They may have different out-of-pocket costs and coverage rules compared to Original Medicare.

3. Prescription Drug Coverage (Part D):

- Medicare Part D helps cover the cost of prescription drugs.

- These plans are offered by private insurance companies approved by Medicare.

- Part D plans vary in cost and coverage, so it's essential to choose a plan that meets your prescription drug needs.

4. Medigap Plans:

- Also known as Medicare supplement plans, Medigap policies are sold by private insurance companies to help fill the gaps in Original Medicare coverage.

- Medigap plans can help cover out-of-pocket costs such as deductibles, copayments, and coinsurance.

- They do not cover services like dental, vision, long-term care, or prescription drugs (unless purchased separately).

5. Coverage Gaps and Limitations:

- Original Medicare may not cover certain services like dental care, vision exams, hearing aids, long-term care, and services provided outside the United States.

- Individuals may need to purchase supplemental insurance, such as Medigap or Medicare Advantage plans, to cover these gaps in coverage.

Navigating the complexities of Medicare and its various parts can be challenging, but our team is here to help you understand your options and choose the coverage that best meets your needs. Contact us today to explore your Medicare options and find the right plan for you.

Quick & Easy, Self-Quoting Tools:

Life, Disability, LTC & Annuities

United Heatlh Insurance

Aetna Health Insurance

ACA Health Insurance

Commercial, Gen Liability

Our Preferred Carriers

Who we are:

Over 20 years of Insuring the Brickell area of Miami, FL

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

"We believe in being a trusted source for each of your insurance needs, dedicated to bringing you advice and options to help you make an informed decision."

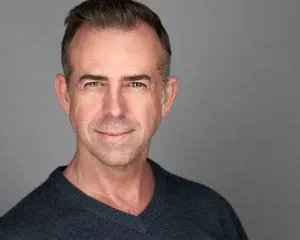

- Mikell Simmons, Founder

What Makes Our Independent Agency Different?

We represent multiple insurance companies.

We are by your side every step of the way.

We are licensed insurance advisors.

We offer a variety of insurance solutions.

We are there for you in your time of need.

Client's Say

Our Mission Statement

At We Insure Everything, our mission is to uphold our founding principles of bringing our clients the highest quality services and solutions to match up with the unique needs of today’s world.

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

Ines - HR 29 September

“Mickell is a very dedicated person, he took the time to look for the best options that would suit my needs and my budget and went through the details and the language of the policy to make it easier for me to understand.”

Santiago - Mgr Dir 14 September

"Mikell thank you for the great work, your sincere approach is really appreciated. You tell me you don't know the details sometimes of something but always seem to find the answer; I like how I can trust you."