Your Insurance Journey

Starts Now

We Insure Everything is here to guide you

every step of the way.

Group Benefits & Administration

How Can We Help You?

Group Benefits & Administration

Click to Expand

How We Do Employee Benefits Better

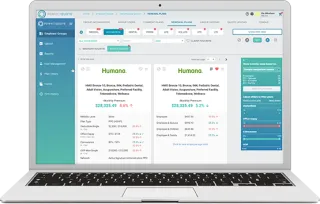

We start by reducing the 3-4 week of reviewing and approving spreadsheets of Quotes down to just one (1) 45 minute Zoom call with all decision makers present. Our technology provides real-time quoting which variables such as Company Contributions, Buy-up Options and Dependent Coverage can be adjusted in real-time.

It sounds like We Insure Everything is streamlining the insurance process for clients by providing a user-friendly platform and comprehensive services. Here's a breakdown of what clients can expect:

1. Elimination of Data Spreadsheets: We Insure Everything eliminates the need for clients to review complex data spreadsheets every year. These spreadsheets, often provided by brokers, can be overwhelming and confusing. By removing this burden, We Insure Everything aims to simplify the insurance process for clients.

2. Powered by PerfectQuote®: The platform is powered by PerfectQuote®, which supports several lines of coverage, including ACA/small group medical and large group medical, dental, life, and disability products. This technology likely streamlines the quote generation and comparison process, making it easier for clients to evaluate their options.

3. Robust Comparison Tools: Clients can expect robust comparison tools that allow them to compare different insurance plans easily. This feature helps clients make informed decisions by evaluating the benefits and costs of each plan side by side.

4. Enrollment and Contribution Modeling: We Insure Everything offers enrollment and contribution modeling, allowing clients to visualize how different plan options may impact their enrollment numbers and contribution amounts. This feature helps clients tailor their insurance plans to meet their specific needs and budget.

5. Exporting Plan Details: Clients have the ability to export plan details to a streamlined spreadsheet, making it easier to review and analyze the information offline. Additionally, clients can present plan details online, facilitating communication and collaboration in today's digital environment.

Overall, the We Insure Everything experience aims to provide clients with an error-free plan analysis process, simplified comparison tools, and efficient enrollment and contribution modeling. This comprehensive approach to insurance services helps clients navigate the complexities of insurance coverage with ease and confidence.

Ben Admin Done Better

Employee Navigator seems to be a comprehensive benefits administration platform designed to simplify the process for both employers and employees.

Here's what clients can expect from Employee Navigator:

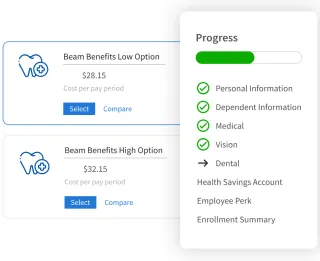

1. Quick Enrollment for New Hires: The platform allows for quick enrollment of new hires, streamlining the onboarding process and ensuring that employees have timely access to benefits.

2. Plan Comparison and Selection: Clients can compare and select from different benefit plans, making it easier to find the options that best suit their needs and budget.

3. Coverage Status Review: Employers can easily review the coverage status for all employees, ensuring that everyone has the necessary benefits in place.

4. Employee Enrollment Monitoring: The platform enables employers to monitor employee enrollment status and deadlines, helping to ensure that everyone is enrolled in a timely manner.

5. Virtual Agency Call Center: Employers can set up their own virtual agency call center, providing employees with a dedicated resource for benefits-related inquiries and support.

6. Document Management: Employee Navigator allows for the storage, review, and acknowledgment of important plan documents, helping to ensure compliance and transparency.

7. Mobile Accessibility: The platform is mobile-friendly, allowing employees to enroll in benefits, view compliance documents, access HR resources, request and view PTO, view company contacts, and review benefit details from their mobile devices.

Overall, Employee Navigator aims to simplify benefits administration by providing a user-friendly interface, comprehensive features, and mobile accessibility. This can lead to a better user experience for both employers and employees, ultimately enhancing the efficiency and effectiveness of benefits management.

Group Health

Group health insurance is indeed a vital component of the employee benefits package, playing a significant role in attracting and retaining top talent while also promoting a healthy and productive workforce. Here's a closer look at why group health insurance is considered a priority for employees and a crucial investment for employers:

1. Key Employee Benefit: Group health insurance is often viewed by employees as one of the most important benefits offered by their employer. Access to quality healthcare coverage provides employees with peace of mind regarding their health and well-being, which can contribute to job satisfaction and overall morale.

2. Recruitment and Retention: Offering group health insurance can give your business a competitive edge in the job market, helping attract skilled professionals and retain valuable employees. In today's competitive labor market, comprehensive health benefits can differentiate your company from competitors and enhance your employer brand.

3. Economical Solution: Group health insurance plans are typically more cost-effective for both employers and employees compared to individual health insurance policies. By pooling the risk of a larger group of individuals, employers can negotiate lower premiums and provide employees with access to more extensive coverage options at a lower cost.

4. Coverage Options: Group health insurance plans offer flexibility in coverage options, allowing employers to tailor benefits to meet the needs of their workforce. Depending on the plan, employers may choose to provide coverage for employees only or extend coverage to include their dependents, such as spouses and children.

5. Shared Cost: Employers have the flexibility to structure their group health insurance plans to share the cost of premiums with employees. This shared financial responsibility demonstrates the employer's commitment to supporting employee health and well-being while also promoting cost-consciousness among employees.

Navigating the complex landscape of healthcare and insurance options can be challenging for employers. That's where our expertise comes in. We can help you design and implement a group health insurance plan that meets the needs of your employees while aligning with your business goals and budget.

Contact us today to explore your options and ensure that you're providing comprehensive health coverage to your workforce.

Group Life

Accidental death and dismemberment (AD&D) insurance provides an added layer of financial protection for employees in the event of an accident, whether it occurs on or off the job. Here's how it works:

1. Coverage for Accidents: AD&D insurance kicks in specifically in the event of accidental death or severe injury resulting from an accident. This coverage complements traditional life insurance and workers' compensation by providing additional financial support in cases of accidental death or dismemberment.

2. Financial Protection for Dependents: Similar to life insurance, AD&D insurance aims to provide financial support to the employee's dependents in the event of accidental death. It helps replace lost income and can assist with covering expenses such as mortgage payments, tuition fees, and other financial obligations.

3. Duration of Coverage: The coverage provided by AD&D insurance may vary depending on the policy. It could last for a limited period, until the employee reaches retirement age, or until their death, regardless of when it occurs.

4. Accidental Death vs. Natural Causes: Unlike traditional life insurance, which covers death from any cause, AD&D insurance specifically covers death resulting from accidents. This includes events such as car accidents, falls, drowning, and other unforeseen incidents.

5. Dismemberment Benefits: In addition to providing benefits for accidental death, AD&D insurance may also offer benefits for severe injuries resulting in the loss of limbs or other significant impairments. These benefits can help cover medical expenses and provide financial support during recovery.

Overall, AD&D insurance serves as a valuable complement to traditional life insurance and can offer employees and their families added peace of mind in the face of unexpected accidents. It provides financial protection in situations where workers' compensation and standard life insurance may not fully cover the costs associated with accidental death or injury.

Group Dental, Vision

Offering comprehensive dental and vision coverage as part of your benefits package can be a significant advantage for both your employees and your business. Here's why:

1. Cost-Effective Dental Coverage: Dental care expenses can add up quickly, especially for procedures beyond routine check-ups. By providing group dental coverage, you help employees manage the cost of preventive care, fillings, root canals, and other dental procedures. This not only promotes oral health but also enhances overall well-being.

2. Attractive Benefits Package: Group dental coverage is highly valued by employees and is often considered an essential part of the benefits package. By offering comprehensive dental insurance, you can attract and retain top talent, demonstrating your commitment to their health and wellness.

3. Improved Employee Health: Regular dental check-ups not only maintain oral health but can also detect underlying medical conditions early on, such as heart disease and diabetes. By encouraging preventive dental care, you contribute to your employees' overall health and productivity in the workplace.

4. Vision Care for Better Health: Vision insurance is equally important for maintaining overall health. Routine eye exams can detect not only changes in vision but also early signs of serious health conditions like diabetes and hypertension. By providing group vision coverage, you empower employees to prioritize their eye health and overall well-being.

5. Comprehensive Coverage Options: Group vision insurance plans typically cover a wide range of services, including eye exams, frames, lenses, contact lenses, and even safety glasses. This comprehensive coverage ensures that employees have access to the vision care they need without incurring significant out-of-pocket expenses.

By offering comprehensive dental and vision coverage, you demonstrate your commitment to employee well-being while also enhancing your overall benefits package. This can lead to increased employee satisfaction, retention, and productivity, ultimately benefiting your business in the long run.

Group Voluntary Benefits

Offering group voluntary benefits can indeed be a valuable way for employers to provide their employees with access to essential medical benefits at lower costs, even if the employer is unable to cover the full cost of healthcare or life insurance plans. Here's how group voluntary benefits work and why they can be beneficial for both employers and employees:

1. Access to Affordable Coverage: Group voluntary benefits allow employees to access certain medical benefits, such as health insurance or life insurance, at lower premiums compared to purchasing individual policies. By leveraging the group purchasing power, employees can secure coverage at more affordable rates, providing them with financial protection and peace of mind.

2. No Cost to the Employer: One of the key advantages of group voluntary benefits is that they typically come at no cost to the employer. Employers can offer these benefits as a value-added perk to their employees without incurring any additional expenses or administrative burden. The employer simply facilitates the enrollment process and payroll deductions, making it a hassle-free solution.

3. Enhanced Employee Satisfaction: Providing access to affordable medical benefits through group voluntary benefits can enhance employee satisfaction and morale. Employees appreciate the opportunity to secure valuable coverage for themselves and their families at discounted rates, which can contribute to their overall well-being and job satisfaction.

4. Retention and Recruitment: Offering group voluntary benefits can also help employers attract and retain top talent. In today's competitive job market, comprehensive benefits packages play a crucial role in employee recruitment and retention efforts. Employers that offer attractive benefits, including group voluntary benefits, are more likely to stand out to prospective employees and retain their current workforce.

5. Customizable Options: Group voluntary benefits programs often offer customizable options, allowing employers to tailor the benefits package to meet the unique needs and preferences of their workforce. Employers can choose from a variety of benefit options, such as health insurance, dental insurance, vision coverage, and life insurance, to create a comprehensive benefits package that aligns with their employees' needs.

By offering group voluntary benefits, employers can demonstrate their commitment to supporting employee well-being and financial security without incurring additional costs. This can lead to a happier, healthier, and more engaged workforce, ultimately benefiting the employer's bottom line.

If you're interested in exploring group voluntary benefits for your business, contact us today to learn more about your options and how we can help you implement a benefits program that meets your employees' needs.

Payroll / HR Benefit Admin

Employee Navigator is how we provide a better user experience and better product for our clients.

The truly all-in-one benefits solution you’ve been waiting for.

Change the way that benefits are handled. Here’s what Employee Navigator has to offer:

Get new hires enrolled quickly.

Compare and select plans.

Review coverage status for all employees.

Monitor employee enrollment status and deadlines.

Setup your own virtual agency call center.

Store, review, and acknowledge important plan documents.

Employee Navigator is mobile.

We’ve made it simple for employees to enroll and access their benefits and HR resources online from their mobile device. Employees can:

Enroll in their benefits.

View compliance documents.

Request and view their PTO.

View list of company contacts.

View their benefit details.

Our Preferred Carriers

Who we are:

Over 20 years of Insuring the Brickell area of Miami, FL

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

"We believe in being a trusted source for each of your insurance needs, dedicated to bringing you advice and options to help you make an informed decision."

- Mikell Simmons, Founder

Our Services

What Makes Our Independent Agency Different?

We represent multiple insurance companies.

We are by your side every step of the way.

We are licensed insurance advisors.

We offer a variety of insurance solutions.

We are there for you in your time of need.

Client's Say

Our Mission Statement

At We Insure Everything, our mission is to uphold our founding principles of bringing our clients the highest quality services and solutions to match up with the unique needs of today’s world.

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

Ines - HR 29 September

“Mickell is a very dedicated person, he took the time to look for the best options that would suit my needs and my budget and went through the details and the language of the policy to make it easier for me to understand.”

Santiago - Mgr Dir 14 September

"Mikell thank you for the great work, your sincere approach is really appreciated. You tell me you don't know the details sometimes of something but always seem to find the answer; I like how I can trust you."