Your Insurance Journey

Starts Now

We Insure Everything is here to guide you

every step of the way.

Our Name Says It All

From your boat to your business and everything in between, We Insure Everything!

Who we are:

Over 20 years of Insuring the Families & Businesses of the Brickell area in Florida

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

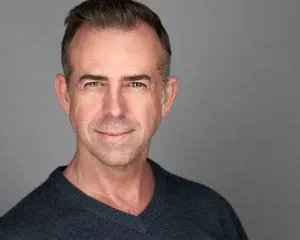

"We believe in being a trusted source for each of your insurance needs, dedicated to bringing you advice and options to help you make an informed decision."

- Mikell Simmons, Founder

Quick & Easy, Self-Quoting Tools:

Life, Disability, LTC & Annuities

United Health Insurance

Aetna Health Insurance

ACA Health Insurance

Our Services

What Makes Our Independent Agency Different?

Our Preferred Carriers

Client's Say

Our Mission Statement

At We Insure Everything, our mission is to uphold our founding principles of bringing our clients the highest quality services and solutions to match up with the unique needs of today’s world.

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

Ines - HR

“Mickell is a very dedicated person, he took the time to look for the best options that would suit my needs and my budget and went through the details and the language of the policy to make it easier for me to understand.”

Santiago - Mgr Dir

"Mikell thank you for the great work, your sincere approach is really appreciated. You tell me you don't know the details sometimes of something but always seem to find the answer; I like how I can trust you."

We Insure Everything LLC is a fully licensed insurance agency licensed in Florida & Texas, and also affiliated with a nation-wide insurance referral network, AgentPro! LLC, which provides access to specialists in all areas of insurance in every state. We only market to our services to FL & TX but we can help locate a specialist for whatever & wherever you need. *We will confirm with you if your insurance need can be placed with a specialist from AgentPro!