Your Insurance Journey

Starts Now

We Insure Everything is here to guide you

every step of the way.

Commercial Insurance

Our Services

Commercial Insurance

Click to Expand

Business Owners Policy (BOP)

A Business Owners Policy (BOP) is a comprehensive insurance solution that combines both business property and liability insurance into a single policy. Here's why your business needs BOP coverage:

1. Protection Against Unexpected Risks: Every business faces various risks on a daily basis, ranging from property damage to liability claims. With a BOP, you can protect your business from these unexpected events and minimize financial losses.

2. Convenience: BOP offers the convenience of having two essential coverages bundled into one policy, simplifying the insurance process for business owners. Instead of managing multiple policies, you can have all your coverage needs addressed in a single policy.

3. Property Insurance Coverage: BOP includes property insurance, which covers risks associated with your business premises, equipment, and vehicles. This coverage protects against perils such as fire, flooding, theft, accidental damage, and loss of income due to property damage.

4. Liability Insurance Coverage: In addition to property insurance, BOP includes liability insurance, which covers damage to third parties and their property. This coverage is crucial for businesses that interact with clients or customers, as it protects against claims of bodily injury or property damage.

5. Customized Coverage: BOP policies can be tailored to meet the specific needs of your business. Whether you're a startup or an established business, you can customize your BOP to ensure that it provides adequate coverage for your unique risks and exposures.

6. Cost-Effective Solution: Purchasing a BOP is often more cost-effective than buying separate policies for property and liability insurance. By bundling your coverage, you may be able to save money on premiums while still enjoying comprehensive protection.

7. Expert Guidance: Working with insurance professionals who understand your business is essential in designing the right BOP for your needs. They can assess your risks, recommend appropriate coverage options, and help you navigate the insurance process effectively.

At We Insure Everything, we specialize in designing tailored BOP coverage that meets the needs of businesses across various industries. Our priority is to understand your business and develop a comprehensive insurance solution that protects your business, income, and assets.

Contact us today to learn more about the benefits of BOP coverage and to get started with a custom plan for your business.

Workers' Comp

Workers’ compensation insurance is a vital investment for businesses, providing coverage for employees injured on the job or in work-related accidents. Here’s why your business needs workers’ comp coverage:

1. Legal Requirement: In most states, workers’ compensation insurance is a legal requirement for businesses with employees. Failing to carry this coverage can result in costly penalties and legal consequences. By ensuring compliance with state regulations, you protect your business from potential legal liabilities.

2. Employee Safety and Security: Workers’ comp insurance demonstrates your commitment to the safety and well-being of your employees. In the event of a workplace injury or illness, workers’ comp provides financial protection for medical expenses, rehabilitation costs, and lost wages. This coverage helps employees recover from injuries and return to work without facing financial hardship.

3. Coverage for Various Risks: Workers’ compensation insurance covers a range of scenarios, including injuries sustained on the job, work-related illnesses, and auto accidents that occur while employees are on business. By addressing these risks, workers’ comp safeguards your business from potential lawsuits and financial liabilities.

4. Comprehensive Benefits: Workers’ comp benefits typically include coverage for medical treatment, rehabilitation services, and a portion of lost wages for injured employees. Additionally, in the event of a fatal injury, workers’ comp provides death benefits and funeral expenses, offering support to the employee’s family during a difficult time.

5. Protection Against Legal Action: In addition to providing financial benefits to injured employees, workers’ comp insurance often includes coverage for legal expenses if an employee files a lawsuit related to a workplace injury. This protects your business from costly litigation and legal fees.

6. Flexible Coverage Options: Workers’ compensation insurance can be tailored to meet the specific needs of your business. Whether you require coverage above the legal minimums or want to combine workers’ comp with other insurance policies, such as a business owners policy (BOP) or general liability insurance, you have flexibility in designing your coverage.

At We Insure Everything, our insurance experts specialize in helping businesses obtain the right workers’ compensation insurance to protect their employees and their bottom line. We understand the unique risks faced by businesses across various industries and can customize a policy to fit your specific needs.

Contact us today to learn more about workers’ comp coverage and to get started with a comprehensive insurance solution for your business.

Special Event

Special event insurance, also known as event liability coverage, is essential for protecting your festivities and securing coverage for potential risks that may arise during your event. Here's why you need it:

1. Liability Coverage: Event liability insurance offers coverage for liability issues such as property damage or personal injury caused by you or a guest during your event. Most venues require this coverage, and it may cover costs for medical bills and property replacement if a guest is injured or damages property during the event.

2. Cancellation Coverage: Event cancellation insurance provides reimbursement for lost deposits and other fees if you need to cancel or postpone your event due to unforeseen circumstances. This coverage protects you from financial loss if a vendor, venue, or extreme weather forces you to cancel the event. It may also cover cancellations due to illness, including communicable diseases like COVID-19.

3. Host Liquor Liability: If you're serving alcohol at your event, host liquor liability insurance is crucial. This coverage protects you in case an alcohol-related accident results in property damage or injury. For example, if a guest becomes intoxicated and causes harm or damage, you could be held responsible. Host liquor liability insurance may cover costs associated with lawsuits, medical bills, and property damage arising from alcohol service.

4. Coverage for Various Events: Special event insurance can cover a wide range of events, including weddings, anniversary parties, birthday parties, retirement parties, graduations, family reunions, and baby showers. However, some events like bachelor or bachelorette parties may be excluded from coverage.

5. Timing of Coverage: It's advisable to obtain special event coverage once you start making deposits and payments for vendors, services, and event-related items. The duration of your event, whether it's a few hours or several days, may affect your coverage needs and timing.

By considering special event insurance, you can protect yourself from financial loss and ensure that your event runs smoothly.

Contact us to discuss your event and explore possible coverage options tailored to your needs.

Rental Property

Ensuring Your Peace of Mind as a Property Owner

While your tenant may have their own rental insurance, it's crucial to understand that their coverage doesn't necessarily extend to you as the property owner. Rental property insurance is specifically crafted to address the unique risks faced when renting out your property to others.

The Essential Policy for Property Owners

Rental property insurance is a specialized form of home insurance tailored for property owners rather than tenants. Similar to a homeowners policy, it takes into account the distinct risks associated with renting out a property as opposed to residing in it yourself.

What's Covered by Rental Property Insurance?

In addition to coverage for damage to the building itself and your personal property, such as included furniture, a rental property policy often includes provisions for lost income resulting from property damage that renders the property temporarily unrentable. Furthermore, it typically offers liability coverage in the event of tenant injury lawsuits.

Mitigating Risks of Renting Out Property

Rental property insurance addresses various risks involved in renting out a property, including expenses related to tenant relocations during repairs and compensation for disruptions in essential services like heating or air conditioning.

Exclusions to Note

It's important to recognize that rental property policies typically do not cover loss of income resulting from tenant rent defaults or the expenses associated with tenant eviction.

Get the Right Coverage Today

If you have any inquiries regarding rental property insurance or need assistance in finding the most suitable policy for your needs, don't hesitate to reach out to us. We're here to ensure that you're adequately protected as a property owner.

Short-Term Rental

Navigating Insurance for Dual-Use Properties

When your property serves as both your home and a rental space, understanding the intricacies of insurance coverage becomes paramount. As the popularity of short-term and vacation rentals grows, it's crucial to grasp how short-term rental insurance can provide essential protection.

Homeowners Insurance Falls Short

Typically, homeowners insurance is tailored to protect properties occupied by their owners. While it covers property damage and liability, using your home for business purposes, such as short-term rentals, may lead to policy exclusions or even invalidation. For comprehensive protection, short-term rental insurance is essential.

Landlord Insurance Isn't Always Suitable

Landlord insurance, designed for long-term rental properties, may not align with the dual-use nature of your property. It often excludes coverage for tenants' belongings and requires the property to be "non-owner-occupied." If your home serves as your primary residence most of the time, landlord insurance may not be suitable for short-term rental scenarios.

Short-Term Rental Platforms Offer Limited Protection

While short-term rental platforms like Airbnb and Vrbo provide some coverage for hosts, the protection may have low limits and numerous exclusions. It's essential to supplement this coverage with a comprehensive short-term rental insurance policy.

Benefits of Short-Term Rental Insurance

Short-term rental insurance, also known as vacation rental insurance, offers tailored protection for home-share arrangements. These policies cover property damage, liability, and may include coverage for amenities or equipment rental. Additionally, they often provide loss of use or income protection if the property becomes uninhabitable. Navigating the Complexity of Insurance Coverage With numerous options, exclusions, and endorsements available, selecting the right insurance coverage can be daunting. Making an ill-informed choice may result in unnecessary expenses or inadequate coverage. Seeking guidance to find the appropriate short-term rental insurance is essential for safeguarding your property and financial security.

Ready to Rent Out Your Home?

If you're considering renting out your property, reach out to us to explore your short-term rental insurance options. We're here to ensure you have the necessary protection for your dual-use property.

General Liability

General liability insurance is a crucial component of protecting your business against various risks and uncertainties. Here's what you need to know about it:

1. Protection Against Damages: General liability insurance safeguards your business against damage to your buildings, equipment, and staff, as well as damage to other people and businesses. Without this coverage, you could be liable for paying out large sums if you are held responsible for injuries or property damage.

2. Coverage Scope: General liability insurance primarily covers bodily injury to individuals outside of your business and physical damage to their property. It may also cover certain liabilities such as data loss and reputation damage caused by your business. However, it typically does not cover cases where you are sued for providing inadequate professional advice. For this type of risk, you may need errors & omissions insurance (E&O).

3. Requirement and Necessity: General liability insurance is often required for businesses that interact with clients, whether at your business premises or theirs. It may also be a prerequisite for signing contracts with certain clients or businesses. Having this coverage in place demonstrates your commitment to protecting your clients and third parties from potential harm caused by your business operations.

4. Tailored Policies: Every business is unique, and therefore, the insurance needs may vary. We can work with you to determine the appropriate level of coverage and tailor a general liability insurance policy that suits your specific business requirements. Whether you're a small business owner or a large corporation, having the right insurance package in place can provide you with peace of mind and protect your assets in the event of unforeseen incidents.

Don't overlook the importance of general liability insurance for your business.

Contact us to discuss your insurance needs and explore the options available to protect your business against potential risks and liabilities.

Business Auto

Commercial auto insurance is a crucial component of protecting your business vehicles and assets. Here's what you need to know about it:

1. Extra Protection: Commercial auto insurance provides an extra layer of coverage beyond standard auto insurance policies. It's designed to address the unique risks and exposures that come with using vehicles for business purposes.

2. Higher Liability Coverage: One of the key benefits of commercial auto insurance is the ability to obtain higher liability coverage limits compared to personal auto insurance. This reflects the higher level of risk associated with business operations and helps protect your business assets in the event of a lawsuit or claim.

3. Collision Coverage: Commercial auto insurance typically includes collision coverage, which pays for damage to your business vehicles regardless of who is at fault in an accident. This coverage is essential if you lease or finance your vehicles and helps ensure that you can repair or replace them quickly in the event of damage.

4. Employers Non-Owned Car Liability Coverage: This coverage is important for businesses whose employees use their personal vehicles for work purposes. It provides protection in case an employee is involved in an accident while driving their own vehicle for business-related activities, helping to mitigate potential legal complications and financial liabilities for your business.

5. Expert Guidance: Navigating the complexities of commercial auto insurance can be daunting, but our team of experts is here to help. We can assess your business's unique needs, recommend appropriate coverage options, and tailor a policy that provides comprehensive protection for your vehicles and assets.

Don't overlook the importance of commercial auto insurance for your business.

Contact us today to discuss your insurance needs and ensure that your vehicles are properly protected against potential risks and liabilities.

Business Interruption

Business interruption insurance is a vital safeguard for your business, providing financial protection in the event of unforeseen circumstances that force your operations to shut down. Here's what you need to know about this essential coverage:

1. Coverage for Operating Costs: Business interruption insurance helps cover the operating costs of your business during a shutdown period caused by a covered loss. This includes lost revenue, loan payments, rent or mortgage payments, payroll for employees, and taxes.

2. Contingent Business Interruption: In cases where your business relies on other entities to operate, contingent business interruption insurance steps in to protect your income if a covered loss affects non-owned property, such as suppliers or service providers.

3. Extra Expense Coverage: Beyond day-to-day expenses, extra expense insurance covers additional costs incurred during a shutdown, such as temporary relocation, hiring additional staff, paying overtime, or training employees on new equipment.

4. Civil Authority Coverage: This subset of business interruption insurance applies when your business is forced to shut down by a governmental body due to physical damage to adjacent property not owned by your business. It typically covers up to two consecutive weeks.

5. Utility Services Coverage: In cases where your business shuts down due to a loss in essential utilities like gas, water, or electricity, utility services coverage provides financial protection until the utilities are restored. It may also cover direct damage caused by utility shutdowns.

Business interruption insurance is a critical component of protecting your business's financial stability in the face of unexpected disruptions. Our team can help you navigate the complexities of this coverage and tailor a policy to suit your business's unique needs.

Contact us today to learn more and discuss your options for business interruption insurance.

Commercial Construction

Coming Soon...

Commercial Property

Commercial property insurance is indeed essential for protecting your business assets from a variety of risks. Here's a breakdown of its key benefits:

1. Protection Against Loss and Damage: Commercial property insurance provides coverage in the event that your business assets, such as buildings, commercial vehicles, or equipment, are stolen, damaged, or destroyed by perils like fire, flooding, or theft. This coverage helps mitigate the financial impact of such incidents and facilitates the replacement or repair of the affected property.

2. Coverage for Associated Losses: In addition to replacing or repairing damaged property, commercial property insurance can cover associated losses, such as lost income resulting from the temporary shutdown of your business operations due to property damage. This ensures that your business remains financially stable during periods of disruption.

3. Additional Coverage Options: Depending on your policy, commercial property insurance may offer coverage for unexpected costs that arise during the rebuilding or repair process. This can include expenses like complying with local building codes, debris removal, and protection against weather-related damage while reconstruction is underway.

By securing commercial property insurance, you're taking proactive steps to safeguard your business's physical assets and income from unforeseen events.

If you have any questions or need assistance in selecting the right coverage for your business, our team is here to help. Feel free to reach out to us for personalized guidance and support.

Commercial Umbrella

Commercial umbrella insurance is indeed a valuable asset for businesses, providing an additional layer of protection beyond the limits of existing insurance policies. Here are some key points to consider about commercial umbrella insurance:

1. Supplemental Protection: Commercial umbrella insurance serves as a backup for your primary business insurance policies, such as commercial liability or commercial property insurance. It offers additional coverage that becomes effective once the limits of your primary policies are exhausted.

2. Coverage for Excess Claims: When a claim exceeds the payout limit of your primary insurance policy, commercial umbrella insurance steps in to cover the remaining costs, up to the policy's limit. This ensures that your business is not left financially vulnerable to large or unexpected expenses.

3. Affordable Investment: Despite providing substantial coverage, commercial umbrella insurance is often more affordable than you might expect. This is because the likelihood of needing to use the coverage is relatively low compared to the potential financial risk it mitigates.

4. Example Scenario: For instance, if your liability insurance policy has a limit of $500,000 and you face a claim totaling $700,000, your primary policy would cover the initial $500,000, and the commercial umbrella policy would then cover the remaining $200,000, subject to the umbrella policy's limit.

By investing in commercial umbrella insurance, you're taking proactive measures to safeguard your business against unforeseen events and potential financial liabilities.

Our team can assist you in assessing your business's needs and finding the right umbrella solution to provide comprehensive coverage. Feel free to reach out to us for personalized guidance and assistance in selecting the best insurance options for your business.

Employment Practice Liability

Employment Practices Liability Insurance (EPLI) is indeed a crucial coverage for employers, providing protection against claims of discrimination, harassment, wrongful termination, and other employment-related issues. Here's how EPLI can benefit your business and what to consider when obtaining coverage:

1. Coverage for Legal Risks: EPLI covers the risk of facing lawsuits related to employment practices, including claims of discrimination, sexual harassment, retaliation, and other workplace issues. This insurance can help cover legal defense costs, settlements, and judgments resulting from such claims.

2. Protection for the Business and Individuals: EPLI policies typically cover the business entity itself, as well as key individuals such as company directors, officers, and managers. This ensures comprehensive protection for the organization and its leadership against potential liabilities arising from employment-related claims.

3. Focus on Unintentional Actions: EPLI policies generally cover claims resulting from unintentional actions or failures to act, rather than deliberate acts of discrimination or misconduct. This underscores the importance of maintaining a proactive approach to preventing workplace issues and fostering a positive work environment.

4. Considerations When Choosing a Policy: When evaluating EPLI policies, it's essential to consider factors such as whether defense costs are included within the policy's coverage limits, and whether the policy operates on a "claims made" basis. Understanding these aspects can help ensure that your business receives adequate coverage for its specific needs.

Our team can assist you in navigating the various EPLI policies available and determining the right coverage for your business. By proactively managing your risk with EPLI coverage, you can mitigate the financial and reputational impact of employment-related claims.

Feel free to reach out to us for personalized guidance and assistance in selecting the best insurance options for your business.

E&O

Errors and omissions (E&O) liability insurance is indeed crucial for businesses that provide advice, recommendations, design solutions, or represent the needs of others.

Here's why E&O insurance is essential and which businesses can benefit the most from this coverage:

1. Protection Beyond General Liability: While general liability insurance covers physical damage to persons or property, E&O liability insurance focuses on financial losses resulting from professional services or advice provided by your business. This coverage is designed to safeguard against claims of errors, mistakes, or omissions in the services you provide.

2. Coverage for Professional Advice: Businesses that offer professional services or advice, such as consultants, financial advisors, lawyers, architects, and engineers, can benefit significantly from E&O liability insurance. It provides financial protection in the event that a client suffers losses due to alleged errors or negligence in the services rendered.

3. Additional Coverage Areas: E&O liability insurance may also cover unintentional violations of intellectual property laws, such as copyright infringement, as well as claims of defamation or libel. This broader coverage extends beyond traditional professional services to encompass various business activities that involve providing recommendations or solutions to clients.

4. Comprehensive Protection: A comprehensive E&O liability insurance policy not only covers the costs of damages resulting from a claim but also includes coverage for the expenses associated with defending against such claims. This ensures that your business is adequately protected against potential financial losses and legal expenses.

Our team can assist you in finding the right E&O liability insurance policy tailored to your business needs. By securing this coverage, you can mitigate the risks associated with providing professional services and ensure that a simple mistake does not lead to financial devastation.

Contact us today to explore your options for E&O liability insurance and protect your business against potential liabilities.

Directors & Officers Liability

Directors and officers (D&O) liability insurance is indeed a critical safeguard for businesses, protecting directors and officers from claims made against them while serving in their respective roles. Here's why D&O liability insurance is essential and what it covers:

1. Protection from Legal Claims: D&O liability insurance covers directors and officers for claims arising from alleged wrongful acts or decisions made while performing their duties. These claims can include allegations of negligence, errors, omissions, or breaches of fiduciary duty.

2. Coverage for Various Scenarios: D&O liability insurance can provide coverage for a wide range of scenarios, including mistakes or inaccuracies in financial statements, breaches of corporate governance, employment-related disputes, regulatory investigations, and shareholder lawsuits.

3. Exclusions and Limitations: While D&O liability insurance offers valuable protection, it's important to note that policies may contain exclusions for deliberate criminal acts, fraud, or personal profiting. Additionally, coverage limits and policy terms may vary, so it's crucial to review the policy details carefully.

4. Policy Options and Considerations: When purchasing D&O liability insurance, businesses should consider factors such as the coverage period, which may dictate when the claim is made rather than when the alleged act occurred. Additionally, businesses may choose to customize their policies to include specific coverage enhancements or endorsements tailored to their industry or risk profile.

5. Risk Mitigation for Business Leaders: D&O liability insurance not only protects individual directors and officers but also provides assurance to senior leadership, attracting top talent and enabling them to make informed decisions without the fear of personal financial liability.

By obtaining D&O liability insurance, businesses can mitigate the risks associated with corporate governance and protect their senior leadership from potential legal liabilities.

Our team can assist you in assessing your organization's needs and finding the right D&O liability insurance policy to safeguard your business and its leaders.

Contact us today to learn more about D&O liability insurance and explore your coverage options.

Flood

Protecting your business from the devastating effects of flooding is crucial for ensuring its continued operation and resilience.

Here's why you should consider obtaining flood insurance for your business:

1. Coverage Gap with Commercial Property Insurance: Many business owners are unaware that their commercial property insurance may not cover damage caused by flooding. Without adequate flood insurance, the financial burden of repairing or replacing damaged property and assets falls squarely on the business owner.

2. Mitigating Risk and Financial Loss: Flood events can result in significant financial losses for businesses, including property damage, inventory loss, and business interruption expenses. By securing flood insurance, businesses can mitigate these risks and protect their financial stability in the event of a flood-related disaster.

3. Timely Coverage Activation: It's important to note that flood insurance policies often have a waiting period before they take effect, typically around 30 days. Therefore, delaying the purchase of flood insurance until severe weather is imminent may leave your business vulnerable to uncovered losses. Obtaining coverage sooner rather than later ensures that your business is protected when flood events occur.

4. Understanding Flood Risks: While heavy rainfall can contribute to flooding, other factors such as clogged drains or storm surges can also lead to inundation. Business owners should assess the flood risks specific to their location and consider the potential impact on their operations.

5. Exploring Insurance Options: Business owners have options when it comes to flood insurance, including policies offered through the federal National Flood Insurance Program (NFIP) and non-NFIP policies. Non-NFIP policies may offer advantages such as full replacement cost coverage and coverage for loss of business income during the rebuilding phase.

By investing in commercial flood insurance, businesses can safeguard their physical assets, financial stability, and operational continuity in the face of flood-related risks.

Our insurance experts can guide you through the process of obtaining the right flood insurance coverage tailored to your business's needs. Don't wait until it's too late—contact us today to explore your options and ensure your business is adequately protected against flood damage.

Crime

Crime insurance is a crucial safeguard for businesses of all sizes, offering protection against various forms of white-collar crime such as theft, fraud, and forgery. Here's what you need to know about this essential coverage:

1. Coverage for Financial Losses: Crime insurance goes beyond traditional property insurance to cover financial losses resulting from crimes committed against your business. This includes theft of money or property, embezzlement, fraudulent activities, and other forms of financial misappropriation.

2. Protection Against Sophisticated Scams: In today's increasingly complex business landscape, criminals have more opportunities to perpetrate sophisticated scams and frauds. Crime insurance provides a layer of protection against these evolving risks, helping businesses mitigate the financial impact of fraudulent activities.

3. Tailored Solutions for Your Business: Every business faces unique risks, and crime insurance policies can be tailored to address specific vulnerabilities and exposures. By working closely with insurers, businesses can design coverage that aligns with their risk profiles and provides adequate protection against potential losses.

4. Risk Mitigation Services: In addition to financial protection, crime insurance often includes risk mitigation services aimed at reducing the likelihood of criminal activities occurring within the business. Insurers may offer advice, support, and expert investigations to help businesses identify and address vulnerabilities proactively.

5. Peace of Mind and Financial Security: By investing in crime insurance, businesses gain peace of mind knowing that they have a comprehensive risk management strategy in place to protect their assets and financial interests. In the event of a crime-related incident, crime insurance provides financial security and support to help businesses recover and move forward.

Don't overlook the importance of crime insurance for your business. By securing appropriate coverage, you can minimize the impact of white-collar crime and safeguard your business against financial losses.

Our team can assist you in exploring crime insurance options tailored to your business's needs.

Contact us today to learn more and get started with protecting your business against crime-related risks.

Builders Risk

Builders risk insurance is a critical safeguard for properties under construction, protecting against a range of risks including fire, theft, and more. Here's what you need to know about this essential coverage:

1. Coverage During Construction: Builders risk insurance provides coverage for properties while they are under construction, offering financial protection against damage or loss resulting from various perils. This coverage is typically essential for property owners, contractors, and developers involved in construction projects.

2. Key Areas of Coverage: Builders risk policies typically cover damage caused by events such as fire, hail storms, theft, vandalism (excluding damage by employees), and damage from vehicles or aircraft. The policy may also extend to cover materials and supplies stored on or near the construction site.

3. Coverage Limitations: While builders risk insurance provides important protection, it's important to be aware of its limitations. For example, certain risks like flooding or earthquakes may not be covered unless specifically stated in the policy. Additionally, injuries suffered by workers are generally not covered, so businesses must ensure they have appropriate workers' compensation insurance in place.

4. Policy Duration and Extensions: Builders risk policies typically have a fixed duration that aligns with the construction timeline. Extensions may be available in certain circumstances, but repeated extensions may not be permitted. It's important to review the policy terms to ensure adequate coverage throughout the construction period.

5. Customized Coverage Solutions: Builders risk insurance can be tailored to suit the specific needs of your construction project. Whether you're constructing a commercial building, residential property, or infrastructure project, builders risk insurance provides invaluable protection against unforeseen risks and losses.

If you're involved in a construction project, securing builders risk insurance is essential to protect your investment and mitigate financial risks.

Our team of insurance experts can help you explore your options and find the right coverage solution for your specific project.

Contact us today to discuss your builders risk insurance needs and request a quote.

Liquor Liability

Liquor liability insurance is a critical safeguard for businesses that serve alcohol, protecting against potential legal liabilities and financial losses resulting from alcohol-related incidents. Here's what you need to know about this essential coverage:

1. Responsibility for Alcohol-Related Incidents: Businesses that serve alcohol can be held responsible for damages or injuries caused by intoxicated customers. This includes situations where customers cause harm to themselves, others, or property after being served alcohol by the business. Even if the business is not directly responsible for the actions of the intoxicated individual, it may still face legal costs and potential liability.

2. Impact of "Dram Shop" Laws: Many states have "dram shop" laws that impose strict liability on businesses that serve alcohol to intoxicated individuals. These laws hold businesses accountable for the actions of intoxicated customers, regardless of whether the business acted recklessly or knowingly served alcohol to someone who was already intoxicated.

3. Coverage Provided by Liquor Liability Insurance: Liquor liability insurance provides financial protection against claims and lawsuits arising from alcohol-related incidents. This coverage typically includes compensation for damages, legal defense costs, and other expenses associated with defending against claims. It may also include coverage for assault and battery claims resulting from incidents involving intoxicated individuals.

4. Additional Coverage Options: In addition to basic liquor liability coverage, businesses may have the option to purchase additional coverage options, such as assault and battery coverage and litigation cost coverage. These additional coverages can provide added protection against various risks and uncertainties associated with alcohol service.

5. Importance of Contacting an Insurance Expert: Understanding the specific terms and coverage details of liquor liability insurance policies is crucial for businesses that serve alcohol. By consulting with an insurance expert, businesses can ensure they have the right coverage in place to protect against potential liabilities and risks associated with alcohol service.

Don't overlook the importance of liquor liability insurance for your business.

Contact us today to learn more about this essential coverage and find the right insurance solution to protect your business against alcohol-related risks and liabilities.

Commercial Bonds

Commercial bonds play a crucial role in providing assurances and protections for various parties involved in business transactions and operations.

Here's a closer look at what commercial bonds are and some common types:

1. Definition of Commercial Bonds: Commercial bonds serve as a form of financial guarantee, providing reassurance to one party (the obligee) that another party (the principal) will fulfill certain obligations or adhere to specific terms outlined in a contract or agreement. Unlike insurance, which covers against losses or damages, bonds focus on ensuring performance or compliance.

2. Types of Commercial Bonds:

- License Bonds: Required by government agencies at the local, state, or federal levels, license bonds (or permit bonds) are mandatory for many businesses before they can obtain a license or permit to operate legally in their industry. These bonds protect consumers by ensuring that businesses comply with industry regulations and laws.

- Bid Bonds: Primarily used in the construction industry, bid bonds are often required by project developers from contractors bidding on construction projects. Bid bonds provide assurance to project developers that contractors submitting bids are financially capable of completing the project and that their bids are genuine and competitive.

- Performance Bonds: Following the acceptance of a bid and awarding of a contract, contractors may need to obtain performance bonds. These bonds guarantee that contractors will fulfill their contractual obligations and complete the project according to the agreed-upon terms and specifications.

- Lost Instrument Bonds: Issued when individuals or entities lose financial instruments such as cashier's checks, money orders, or stock certificates, lost instrument bonds ensure that the issuer won't be liable for duplicating the lost instrument if it is found and cashed. There are fixed penalty bonds for instruments of fixed value and open penalty bonds for fluctuating values.

3. Navigating Bond Requirements: With numerous types of commercial bonds available and varying requirements at different levels of government, navigating the complexities of bond requirements can be challenging for businesses. Working with insurance experts can help businesses identify the types of bonds needed and ensure compliance with federal, state, and local regulations.

Commercial bonds provide peace of mind and financial protection for businesses and stakeholders involved in diverse transactions and industries.

Contact us today to learn more about commercial bonds and their requirements tailored to your business needs.

Surety Bonds

Surety bonds play a crucial role in guaranteeing the completion of projects, especially in industries like construction where large investments are involved.

Here's an overview of when surety bonds are necessary and how they work:

1. Necessity of Surety Bonds: Surety bonds are necessary in situations where one party, known as the obligee, requires a guarantee that another party, known as the principal, will fulfill certain obligations. This is particularly common in government contracts and construction projects, where the obligee seeks assurance that the work will be completed as agreed upon.

2. Functionality of Surety Bonds: When a surety bond is in place, the principal (such as a contractor) pays a premium to an insurer to obtain the bond. In the event that the principal fails to fulfill their obligations, the insurer compensates the obligee (such as a government agency) for any losses incurred. However, unlike traditional insurance, the insurer can then seek reimbursement from the principal for the amount paid out.

3. Principal and Obligee: In the context of surety bonds, the principal is the party that purchases the bond and commits to fulfilling certain obligations, such as completing a construction project. The obligee is the party that receives the benefit of the bond and is protected against financial loss if the principal fails to fulfill their obligations.

Surety bonds provide a mechanism for ensuring that projects are completed as promised and that the obligee is protected against financial loss in the event of non-performance by the principal.

If you have any questions or need further information about surety bonds, feel free to reach out to us for assistance. We're here to help!

Probate Bonds

Probate bonds are essential for ensuring the proper management and distribution of estates and assets by fiduciaries during the probate process.

Here's a breakdown of what probate bonds cover and how they work:

1. Coverage of Probate Bonds: Probate bonds offer financial protection to beneficiaries by guaranteeing that fiduciaries will fulfill their duties lawfully and ethically. These duties include tasks such as filing a will, contacting beneficiaries, verifying the validity of a will, appraising the value of the estate and assets, paying debts owed by the deceased, and distributing inheritances to beneficiaries.

2. Function of Probate Bonds: Probate bonds involve three parties: the fiduciary, the beneficiaries, and the surety bond company. The fiduciary obtains the bond as coverage in case they fail to perform their duties adequately. The beneficiaries are protected by the bond, ensuring that the estate and assets are managed and distributed correctly. The surety bond company guarantees that the fiduciary will fulfill their obligations, providing peace of mind to beneficiaries.

3. Types of Claims Fiduciaries May Face: Fiduciaries may encounter various claims if they fail to fulfill their duties properly. For example, inaccurate appraisal of the estate or failure to contact or pay inheritances to beneficiaries could result in claims. Probate bonds provide protection against such claims, ensuring that beneficiaries are not financially harmed due to fiduciary negligence.

4. Unique Aspects of Probate Bonds: Probate bonds differ from insurance coverage in several ways. While insurance typically covers losses or damages, probate bonds specifically cover fiduciary responsibilities during the probate process. Additionally, probate bonds are often required for court-appointed fiduciaries and cannot be closed or canceled without a court order. There are different types of probate bonds tailored to specific fiduciaries and situations, including executors, trustees, administrators, guardians, conservators, and custodians.

If you require a probate bond for your fiduciary responsibilities, we can assist you in finding a solution that meets your specific needs and circumstances.

Contact us today to discuss your requirements and explore available options.

Inland Marine

Inland marine insurance serves as a vital safeguard for businesses, offering coverage for property and equipment while it's away from the primary business location.

Here's what you need to know about this specialized coverage:

1. Coverage Beyond Commercial Property Insurance: While commercial property insurance protects assets within the business premises, inland marine insurance extends coverage to property and equipment in transit or stored off-site. This is particularly important for businesses that frequently transport goods or equipment to different locations.

2. Diverse Applications: Inland marine insurance is essential for various industries and scenarios. Businesses involved in shipping high-value goods, transporting equipment to trade fairs, or storing third-party equipment on their premises can benefit from this specialized coverage. It provides protection against risks such as theft, damage, or loss during transit or storage.

3. Customized Policies: Inland marine insurance policies are highly customizable to meet the specific needs of each business. Whether you're a manufacturer shipping products to customers, a retailer transporting inventory, or a service provider storing valuable equipment, a tailored policy can ensure comprehensive coverage for your assets.

4. Expert Guidance: Navigating the complexities of inland marine insurance can be challenging, but our team is here to help. We offer expert advice to assess your business's unique needs and determine the most suitable coverage options.

From understanding policy terms to selecting appropriate coverage limits, we'll guide you through the process to ensure your property is adequately protected.

Inland marine insurance provides peace of mind for businesses that rely on transporting or storing valuable assets off-site.

Contact us today to learn more about how inland marine insurance can safeguard your business's property and equipment, no matter where they are located.

Key Person Life

Key person life insurance is a crucial safeguard for businesses, providing financial protection in the event of the death or incapacitation of a key employee who is essential to the company's success.

Here's why key person life insurance is an indispensable coverage for businesses:

1. Ensuring Business Continuity: Senior staff members who possess invaluable skills and knowledge are often indispensable assets to a company. Key person life insurance helps ensure the continuation of business operations by providing financial support to cover expenses and mitigate potential losses resulting from the loss of such individuals.

2. Tailored Coverage for Business Needs: Unlike ordinary life insurance, which primarily benefits the dependents of the insured individual, key person life insurance is specifically designed to address the financial impact on the business itself. It provides a financial cushion to navigate the transitional period following the loss of a key employee.

3. Flexible Payout Options: The payout from a key person life insurance policy can be utilized in various ways to support the business. It may assist in covering operating expenses, recruiting and training replacement personnel, or facilitating an orderly wind-down of operations if necessary. Some policies also offer additional benefits, such as payouts for terminal illness or critical illness.

4. Mitigating Risks and Uncertainties: By investing in key person life insurance, businesses can proactively mitigate the risks associated with the sudden loss or incapacitation of key employees. This coverage helps safeguard the financial stability and reputation of the business, providing peace of mind to employees, customers, and creditors.

Key person life insurance is a strategic investment that can protect the long-term viability of your business.

If you're considering this coverage for your business, we're here to assist you in exploring your options and selecting a policy that aligns with your needs and objectives.

Contact us today to learn more about key person life insurance and how it can benefit your business.

Fiduciary Liability

Fiduciary liability insurance is a specialized coverage designed to protect individuals serving as fiduciaries under the Employee Retirement Income Security Act (ERISA) against claims of mismanagement related to employee benefit plans.

Here's why fiduciary liability insurance is crucial for businesses and trustees:

1. Targeted Coverage for Fiduciary Duties: Fiduciaries, such as officers overseeing employee benefit plans, are entrusted with significant responsibilities under ERISA. They are legally and ethically obligated to act in the best interests of plan participants and beneficiaries. Fiduciary liability insurance specifically addresses the risks associated with breaching these duties, providing financial protection in the event of allegations of mismanagement or errors.

2. Risk Mitigation for Financial Liabilities: Breaching fiduciary duties can result in substantial financial liabilities for individuals and businesses. Fiduciary liability insurance helps mitigate this risk by covering the costs of defending against claims and any resulting liability payments. Given the potential magnitude of losses associated with employee benefit plans, having this specialized coverage is essential for safeguarding the financial interests of fiduciaries and the organization.

3. Comprehensive Protection for ERISA Claims: Claims arising from alleged breaches of fiduciary duties under ERISA can lead to complex and costly legal proceedings. Many general liability insurance policies do not provide coverage for ERISA-related claims, making fiduciary liability insurance indispensable for businesses and trustees. This coverage ensures that defense costs and potential liability payments are adequately addressed, offering peace of mind to fiduciaries and protecting the financial integrity of the organization.

4. Access to Expert Legal Support: Fiduciary liability insurance policies often include access to experienced legal professionals specializing in ERISA cases. This ensures that fiduciaries have the necessary expertise and support to effectively defend against claims and navigate the complexities of ERISA regulations and litigation.

By obtaining a fiduciary liability insurance policy tailored to their business needs, organizations can effectively manage the risks associated with overseeing employee benefit plans and fulfill their fiduciary obligations with confidence.

Our team of experts is dedicated to helping businesses obtain the right coverage to protect their trustees and ensure responsible handling of employee benefits.

Contact us today to learn more about fiduciary liability insurance and how it can benefit your business.

Captive Insurance

Captive insurance is a distinctive approach for businesses to manage their insurance needs, offering greater control, flexibility, and potential tax advantages.

Here's why captive insurance might be an option worth considering for your business:

1. Enhanced Control Over Insurance Costs: By establishing a captive insurance company, businesses can exercise more control over their insurance costs. Instead of relying on premiums set by traditional insurers, businesses can tailor coverage and pricing to better align with their risk profile and financial objectives.

2. Coverage for Unique Risks: Captive insurance allows businesses to cover risks that mainstream insurers may not offer or may be prohibitively expensive. This flexibility enables businesses to obtain tailored coverage for specific risks relevant to their industry or operations, providing comprehensive protection where traditional insurance falls short.

3. Streamlined Claims Process: With captive insurance, businesses can streamline the claims process and reduce the potential for disputes. By managing claims internally through the captive insurance company, businesses can expedite claim resolution, minimize administrative burdens, and maintain greater transparency and control over the claims handling process.

4. Potential Tax Advantages: Captive insurance can offer tax advantages for businesses, potentially reducing overall tax liabilities. Premiums paid to the captive insurance company may be tax-deductible, and under certain conditions, investment income earned by the captive may be tax-deferred or tax-exempt.

5. Ownership and Control: Businesses maintain ownership and control over the captive insurance company, allowing them to make strategic decisions regarding risk management and insurance strategies. While external expertise may be sought for day-to-day management, businesses retain ultimate authority over the captive's operations and governance structure.

6. Risk Management Benefits: Captive insurance facilitates a proactive approach to risk management, encouraging businesses to identify, assess, and mitigate risks effectively. By closely aligning insurance coverage with risk exposure, businesses can enhance their overall risk management strategies and protect against potential liabilities.

Considering the potential advantages of captive insurance, businesses should evaluate whether this approach aligns with their risk management objectives, financial goals, and regulatory considerations.

Consulting with experienced professionals can help businesses assess the feasibility and implementation of captive insurance tailored to their specific needs and circumstances.

If you're interested in exploring captive insurance for your business or learning more about this alternative insurance solution, don't hesitate to reach out to us. We're here to provide guidance and support in navigating the complexities of commercial insurance options.

Vacant Building

Vacant building insurance is essential for protecting your commercial property when it's unoccupied, ensuring coverage for various risks such as fire, theft, vandalism, and more.

Here's what you need to know about vacant building insurance:

1. Definition of Vacancy: Many commercial property insurance policies define a building as vacant if less than 31 percent of its total square footage is occupied and being used for its intended purpose. Understanding this definition is crucial for determining when your building requires vacant building insurance.

2. Limits of Standard Property Insurance: Commercial property insurance typically has limitations and exclusions related to vacant buildings. Coverage for perils like water damage, theft, sprinkler leakage, and vandalism may cease after a certain period of vacancy, and payouts for losses during vacancy may be reduced.

3. Increased Risks: Vacant commercial properties are susceptible to various risks, including fire, theft, vandalism, and water damage. Without occupants to monitor and maintain the property, these risks can escalate, leading to significant property damage and financial losses.

4. Coverage Provided: Vacant building insurance covers named perils such as fire, wind, water damage, theft, and vandalism. Additionally, it may offer liability coverage in case of accidents occurring on the property while it's vacant. Discuss your specific coverage needs with your insurance agent to ensure adequate protection.

5. Importance of Specialized Coverage: Whether your building is temporarily unoccupied between tenants or undergoing renovations, having the right vacant building insurance is crucial for mitigating risks and protecting your investment. It provides peace of mind knowing that your property is safeguarded against unforeseen events during periods of vacancy.

6. Consultation and Coverage Options: To determine the most suitable vacant building insurance policy for your needs, consult with an experienced insurance agent. They can assess your property's risk factors and recommend coverage options tailored to your situation, ensuring comprehensive protection during periods of vacancy.

Don't overlook the importance of vacant building insurance for your commercial property.

Contact us today to discuss your vacant building insurance needs and secure the specialized coverage required to safeguard your investment.

Restaurant Insurance

Crafting a tailored insurance plan for your restaurant is crucial, given the unique risks you face. From property protection to liability coverage, ensuring your business is adequately safeguarded can provide peace of mind and a vital safety net in case of unexpected events.

Restaurant insurance isn't just about covering the basics; it's about understanding the intricacies of your industry and addressing specific risks head-on. For instance, while general liability covers accidents on your premises, professional liability steps in if there's a food-related illness. Recognizing these distinctions can make all the difference in your coverage.

Moreover, it's essential to consider the hidden risks that might not be immediately apparent. From potential fraud and data breaches to the loss of perishable inventory during emergencies, being prepared for these scenarios can save your business from significant financial setbacks.

By partnering with us, you're not just getting insurance; you're gaining a dedicated ally committed to protecting your restaurant. Reach out today, and let's craft a comprehensive insurance plan that works as hard for your business as you do.

We have, what I would say is the best policy structure for restaurants.

Who we are:

Over 20 years of Insuring the Brickell area of Miami, FL

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

"We believe in being a trusted source for each of your insurance needs, dedicated to bringing you advice and options to help you make an informed decision."

- Mikell Simmons, Founder

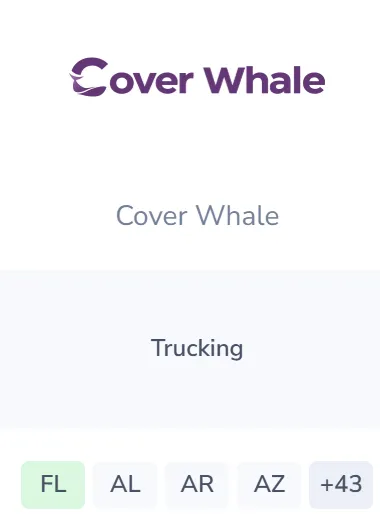

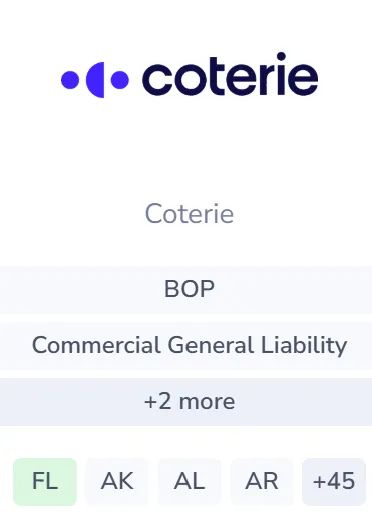

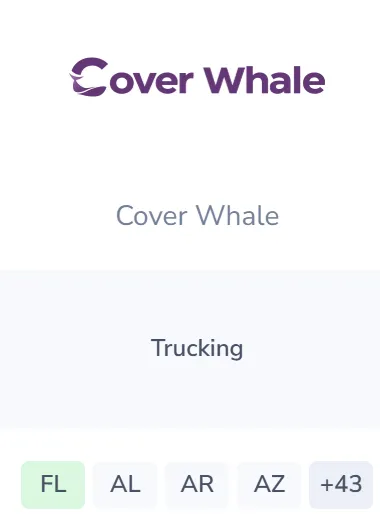

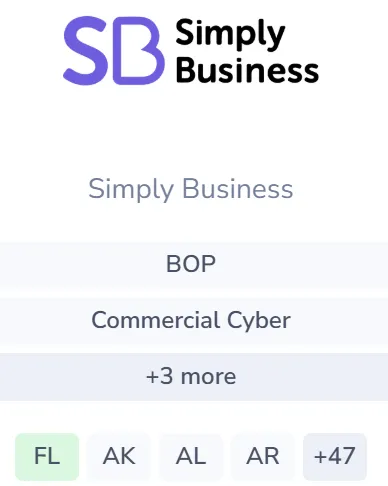

Our Preferred Carriers

It is a long established fact that a reader will be distracted by the readable content of

a page Lorem ipsum dolor sit amet consectetur.

Client's Say

Our Mission Statement

At We Insure Everything, our mission is to uphold our founding principles of bringing our clients the highest quality services and solutions to match up with the unique needs of today’s world.

We are an independent insurance agency.

Specializing in a variety of insurance solutions designed for your unique needs. Because we’re independent, our priority is you—not the insurance company. We represent many different insurance companies that offer a wide variety of coverage options and price points.

Ines - HR 29 September

“Mickell is a very dedicated person, he took the time to look for the best options that would suit my needs and my budget and went through the details and the language of the policy to make it easier for me to understand.”

Santiago - Mgr Dir 14 September

"Mikell thank you for the great work, your sincere approach is really appreciated. You tell me you don't know the details sometimes of something but always seem to find the answer; I like how I can trust you."